- Bank Of Baroda Fixed Deposit Rates Online

- Bank Of Baroda Fixed Deposit Rates Nyc

- Bank Of Baroda Fixed Deposit Rates

BOB Deposits – Great Rates, Convenient and Flexible

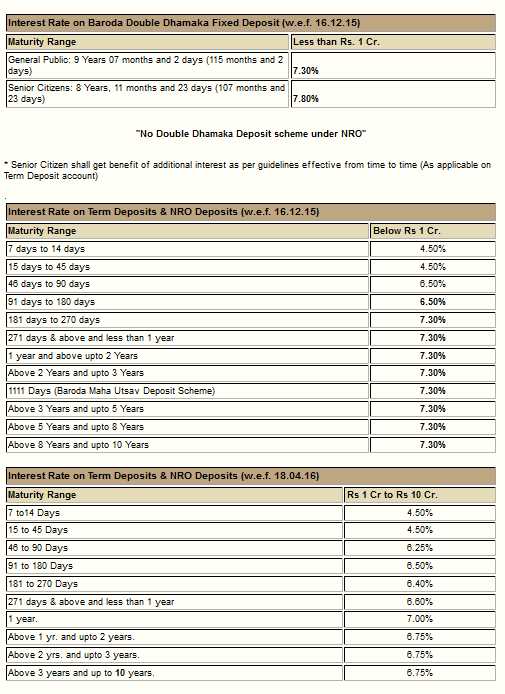

ICICI Bank offers 80 bps higher interest rates on fixed deposits. Senior citizens get an interest rate of 6.30 percent per annum under the ICICI Bank Golden Years FD scheme. Get all the details on Bank of Baroda Fixed Deposit/Term Deposit, NRI/NRE/NRO Deposit Rates, Interest Rates, Fixed Deposits Rating, Fixed Deposits Schemes, NRI deposit rates Bank of Baroda. Bank of Baroda FD Calculator: Get details on Bank of Baroda FD rates on February 2021 by maturity period, deposit amount & fixed deposit interest rate with Bank of Baroda Latest schemes & features. Above 24 months to 36 months.The BOB NRE Fixed Deposit interest rates are subject to change at the discretion of the bank. The interest rates mentioned in this table are valid as of 10 January 2020.

Fixed deposit accounts are an excellent means to grow your money over a period of time. Interest rates on fixed deposit schemes are generally higher than the interest on savings accounts. If you invest in fixed deposits, you can get higher returns for the same amount of money in a savings account in the same period of time.

Bank of Baroda offers several fixed deposit schemes to choose from, depending on your chosen preferred term period (short-term or long-term). This range of choices makes fixed deposits a convenient option for a range of investors, from salaried employees to self-employed professionals to senior citizens.

Bank Of Baroda Fixed Deposit Rates Online

As low-risk instruments, fixed deposit investments offer both, security and competitive interest rates on your principal amount.

For Present rate offered, please visit our Interest rate page.

Most Important Terms & Conditions:

Eligibility

All Individuals and Non-individuals

Amount of Deposit

- Minimum

- SCR 5000.00 and in multiples of SCR 100/-

- Maximum

- No upper limit

Tenure of Deposit

Minimum : 1 Month

Maximum : 120 Months Suntrust mobile deposit.

Rate of interest

As per the maturity period of the deposit

Payment of Interest

Interest will be paid half-yearly.

Premature Closure

No Interest is paid if the deposit is withdrawn before the maturity date.

Availability of Loan/ Overdraft

Overdraft / Loan against deposit provided on demand upto 90 % of the outstanding balance in the account as on date of loan. Interest will be charged as per Bank's extant guidelines from time to time

Others

- Accepted as security by Government departments.

- Accepted as margin for non-fund based activities.

- Withholding Tax: Withholding Tax will be deducted as per Seychelles Revenue Commission guidelines.

- Overdue Deposit: If renewal request is received after date of maturity, such overdue deposits will be renewed with effect from date of maturity at interest rate applicable as on due date provided such request is received within 14 days of maturity of deposit, after which interest for overdue period will be paid at the rate decided by Bank from time to time.

- Advance against Deposits: This facility is not available to Minor account in single name . If the interest is not deposited for more than 2 quarters, term deposit will be apportioned immediately.

- Interest Certificate available at request of customer

- Deposit Certificate – Term Deposit Receipt is provided for all fresh deposit.

- Mode of Payment: Maturity proceeds are credited Saving/ Current account of the customer. In cases where there are no operative accounts of the customer, maturity proceeds can be given in cash below SCR 20,000 above which DD/ Banker's Cheque will be issued.

Bulk Deposits (More than SCR 1 Million)

- Bulk deposits can be opened under any of the above mentioned schemes under retail time deposits.

- Bank reserves the right to accept the deposits above SCR 5 Million.

- Rate of interest for Bulk deposits is different from retail time deposits.For interest rate on bulk deposit, please contact the branch.

- Bank reserves the right to accept request for premature payment as the same is agreed at the time of account opening by the customer. On acceptance of premature payment request, no interest will be paid on such prematurely withdrawn deposits.

You can see below links also

Available Services for Term Deposit Account Holder

- Loan upto 90% of the Deposit amount

- Locker Facility

- Free Internet Banking

- Free SMS alert before maturity date

A fixed deposit (FD) is the financial facility provided by almost all the banks. In this scheme, individuals have to deposit a fixed amount in a bank for a fixed period of time. And after the said period, individuals will get a deposited amount with the decided interest. The interest rate of the fixed deposit (FD) is higher than the regular savings account. Today on this page, we will discuss the BOB FD interest rate, features, benefit, and other important points.

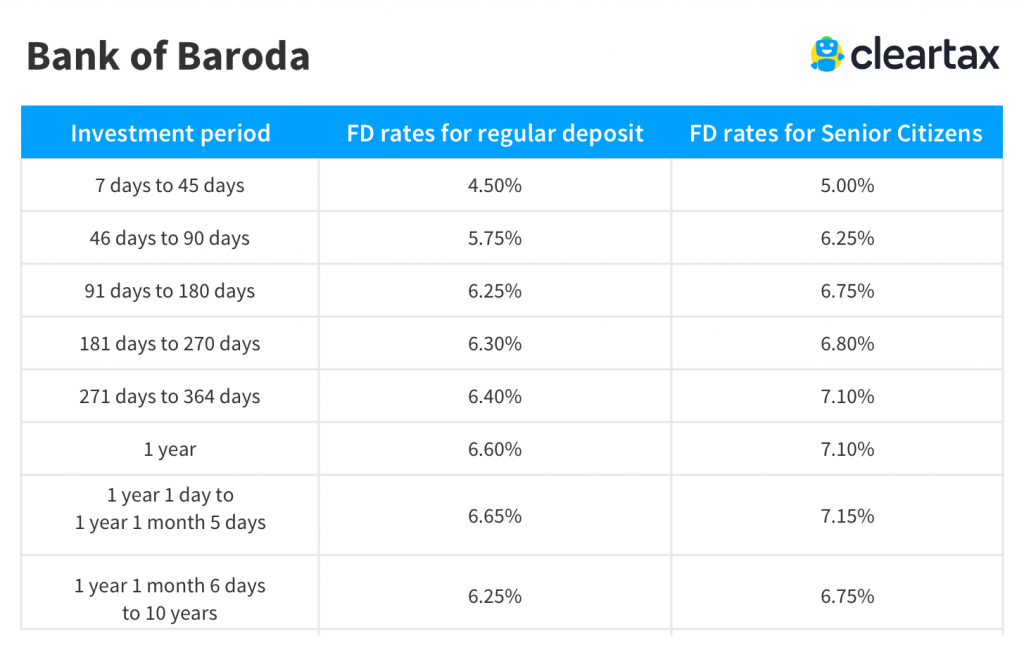

Bank of Baroda offers various fixed deposit (FD) options with an excellent rate of interest (ROI). The BOB provides the FD scheme for both long as well as a short period of time. The Bank Of Baroda FD Interest rate are set as per the category of the individuals. Like the senior citizen will get the 0.50% extra interest p.a. over regular rates.

Bank of Baroda FD- Special Features

- The Bank of Baroda provides Fixed Deposit Facility from 7 days to 10 years

- Senior citizens who have holding Fixed Deposit in BOB can enjoy the interest hike of 0.50% p.a. over regular rates.

- Nomination facility is provided by the bank

- Any account holder can open his/her account in BOB with a minimum of Rs 1,000

- An individual can also take the loan up to 90% of the available deposit

- Interest on the fixed deposit will be paid only at the time of maturity

- Various schemes provided by the BOB for fixed deposit

- Short Deposit

- BOB Suvidha Fixed Deposit Scheme

- Baroda tax Savings Term Deposit

- Regular Income plan

- Baroda Double Dhamaka Deposit Scheme

- Money Multiplier Deposit

- Baroda Advantage Fixed Deposits Non-Callable

- Fast Access Deposit

- Monthly Income Plan

BOB Fixed Deposit- Benefits

- A person having a fixed deposit with the bank has an option to take a loan up to 85% – 95% against FD.

- An individual can also withdraw their fixed deposit by paying a penalty of 1%

- The bank will charge no penalty for deposits in-force for a minimum of 12 months

- You can also set an auto-renewal for FD

- The FD holder can also choose a nominee as per his/her choice.

- The bank will not charge any fees for any for loans and advances against fixed deposits

Maximum : 120 Months Suntrust mobile deposit.

Rate of interest

As per the maturity period of the deposit

Payment of Interest

Interest will be paid half-yearly.

Premature Closure

No Interest is paid if the deposit is withdrawn before the maturity date.

Availability of Loan/ Overdraft

Overdraft / Loan against deposit provided on demand upto 90 % of the outstanding balance in the account as on date of loan. Interest will be charged as per Bank's extant guidelines from time to time

Others

- Accepted as security by Government departments.

- Accepted as margin for non-fund based activities.

- Withholding Tax: Withholding Tax will be deducted as per Seychelles Revenue Commission guidelines.

- Overdue Deposit: If renewal request is received after date of maturity, such overdue deposits will be renewed with effect from date of maturity at interest rate applicable as on due date provided such request is received within 14 days of maturity of deposit, after which interest for overdue period will be paid at the rate decided by Bank from time to time.

- Advance against Deposits: This facility is not available to Minor account in single name . If the interest is not deposited for more than 2 quarters, term deposit will be apportioned immediately.

- Interest Certificate available at request of customer

- Deposit Certificate – Term Deposit Receipt is provided for all fresh deposit.

- Mode of Payment: Maturity proceeds are credited Saving/ Current account of the customer. In cases where there are no operative accounts of the customer, maturity proceeds can be given in cash below SCR 20,000 above which DD/ Banker's Cheque will be issued.

Bulk Deposits (More than SCR 1 Million)

- Bulk deposits can be opened under any of the above mentioned schemes under retail time deposits.

- Bank reserves the right to accept the deposits above SCR 5 Million.

- Rate of interest for Bulk deposits is different from retail time deposits.For interest rate on bulk deposit, please contact the branch.

- Bank reserves the right to accept request for premature payment as the same is agreed at the time of account opening by the customer. On acceptance of premature payment request, no interest will be paid on such prematurely withdrawn deposits.

You can see below links also

Available Services for Term Deposit Account Holder

- Loan upto 90% of the Deposit amount

- Locker Facility

- Free Internet Banking

- Free SMS alert before maturity date

A fixed deposit (FD) is the financial facility provided by almost all the banks. In this scheme, individuals have to deposit a fixed amount in a bank for a fixed period of time. And after the said period, individuals will get a deposited amount with the decided interest. The interest rate of the fixed deposit (FD) is higher than the regular savings account. Today on this page, we will discuss the BOB FD interest rate, features, benefit, and other important points.

Bank of Baroda offers various fixed deposit (FD) options with an excellent rate of interest (ROI). The BOB provides the FD scheme for both long as well as a short period of time. The Bank Of Baroda FD Interest rate are set as per the category of the individuals. Like the senior citizen will get the 0.50% extra interest p.a. over regular rates.

Bank of Baroda FD- Special Features

- The Bank of Baroda provides Fixed Deposit Facility from 7 days to 10 years

- Senior citizens who have holding Fixed Deposit in BOB can enjoy the interest hike of 0.50% p.a. over regular rates.

- Nomination facility is provided by the bank

- Any account holder can open his/her account in BOB with a minimum of Rs 1,000

- An individual can also take the loan up to 90% of the available deposit

- Interest on the fixed deposit will be paid only at the time of maturity

- Various schemes provided by the BOB for fixed deposit

- Short Deposit

- BOB Suvidha Fixed Deposit Scheme

- Baroda tax Savings Term Deposit

- Regular Income plan

- Baroda Double Dhamaka Deposit Scheme

- Money Multiplier Deposit

- Baroda Advantage Fixed Deposits Non-Callable

- Fast Access Deposit

- Monthly Income Plan

BOB Fixed Deposit- Benefits

- A person having a fixed deposit with the bank has an option to take a loan up to 85% – 95% against FD.

- An individual can also withdraw their fixed deposit by paying a penalty of 1%

- The bank will charge no penalty for deposits in-force for a minimum of 12 months

- You can also set an auto-renewal for FD

- The FD holder can also choose a nominee as per his/her choice.

- The bank will not charge any fees for any for loans and advances against fixed deposits

Bank Of Baroda FD Interest Rate

Bank of Baroda FD Rates- NRE

Bank Of Baroda Fixed Deposit Rates Nyc

Bank of Baroda Fixed Deposit Rates- FCNR (B)

Bank of Baroda- Tax Savings Term Deposit

Bank Of Baroda Fixed Deposit Rates

- बैंक सखी योजना क्या है | Bank Sakhi Scheme – योग्यता, ऑनलाइन फॉर्म की जानकारी - June 22, 2020

- Bad bank (बैड बैंक) क्या है | What is Bad Bank Explained in Hindi - June 22, 2020

- टर्म इन्शुरन्स क्या होता है | Term Life Insurance Explained in Hindi - June 22, 2020